D'CENT isn't the only option. Stop positioning it as "the" solution. D'CENT has features other wallets don't - biometric security, heir access codes, multi-asset support. Those are legitimate advantages for specific use cases. But Ledger and Trezor have been around longer, have larger user bases, and work fine for most people. Saying D'CENT is "the go-to" ignores that millions of people successfully use other hardware wallets. The right cold wallet depends on your priorities: Want biometric access and heir planning? D'CENT makes sense. Want the most battle-tested option with widest asset support? Ledger or Trezor. Want air-gapped security with no Bluetooth? Coldcard for Bitcoin. Want the cheapest functional option? Any of them work at different price points. "Secure, simple, and reliable" describes every major hardware wallet. They all do the basic job - keep your keys offline and protected. The differences are in specific features, not fundamental security. If you're recommending D'CENT because you actually use it and prefer the biometric/heir features, say that. If you're recommending it because of an affiliate deal or sponsorship, disclose that. #fypシ #xrp #FutureOfFinance #DigitalAssets

Jake Claver

@jake_claverfqpInvestor | Fintech & Web3 Expert | Family Office Professional | XRP

🔎 Détails (profil + refresh) ouvrir

okenization doesn't automatically require XRP. The thesis goes: real-world assets get tokenized (stocks, bonds, real estate, commodities), those tokens need to move between blockchains and traditional systems, XRP becomes the bridge. If trillions in tokenized assets flow through XRP for settlement, the price has to rise to provide enough liquidity. That makes logical sense. But it assumes XRP wins the tokenization settlement layer, which isn't guaranteed. Competitors exist. Ethereum already has tokenization infrastructure. Hedera, Avalanche, and others are positioning for this. Stablecoins might handle most of it. Banks might build proprietary systems. XRP could end up as one option among many, not the dominant bridge. Tokenization is coming - that part seems likely. Which infrastructure handles it is still open. XRP has advantages (speed, cost, designed for payments), but first-mover advantage in crypto hasn't been permanent for anything else. Five-figure XRP by 2030 requires: (1) massive tokenization adoption, (2) XRP becoming the primary settlement layer for that activity, (3) enough supply getting locked up to create scarcity at current volumes. All three have to happen, not just one. #fypシ #Trust #viral #xrp #public

Nothing in markets is "unstoppable." That's hype, not analysis. XRP has infrastructure. RippleNet exists, ODL functions, custody solutions are available, regulatory clarity is improving. All of that is real. But "when momentum hits, growth will be unstoppable" ignores that markets don't work that way. Assets can have perfect infrastructure and still fail to gain adoption. They can have momentum and then lose it. Nothing is inevitable. Tech companies with superior products lose to inferior competitors constantly because execution, timing, network effects, and luck matter as much as infrastructure. XRP having the technical capability doesn't guarantee banks adopt it over alternatives. "Matter of timing" implies the outcome is certain, just waiting for the right moment. That's not how this works. The outcome is uncertain. Timing affects probability, but it doesn't eliminate competition, regulatory risk, or the chance that institutions choose different solutions. If you believe XRP succeeds, explain why based on specific developments - partnerships, volume growth, regulatory wins, competitive advantages. Don't dress up hopium as inevitability. Markets are never unstoppable. Assets that looked inevitable have crashed to zero. Projects with all the right infrastructure have been replaced by faster-moving competitors. Confidence is fine, but treating anything as guaranteed is how people hold too long or size positions irresponsibly. XRP might succeed. It might not. The infrastructure helps. #fypシ #xrp #viral #Trust

PMLLCs need maintenance or they lose their protections. File annual reports in your formation state. Some states require them every year, others every two years. Miss the deadline and your LLC can be administratively dissolved, which means you lose the liability protection. Pay franchise taxes or annual fees. Amounts vary by state - Wyoming charges $60 annually, California charges $800 minimum. Skip payment and the state can dissolve your entity or suspend your ability to do business. Keep business and personal finances separate. If you're mixing funds - paying personal expenses from LLC accounts or vice versa - courts can pierce the corporate veil and hold you personally liable for business debts. Maintain proper documentation. Operating agreements, member meetings (even if you're the only member), records of major decisions. This proves the LLC is a real entity, not just a shell you're using to avoid personal responsibility. Update registered agent if you move or if your agent service changes. The state needs a reliable address to send legal notices. Miss those notices and you can lose cases by default. "Before the new year" matters because many states have filing deadlines tied to formation anniversary or calendar year-end Getting behind creates penalties and potential dissolution. An LLC provides protection, but only if you maintain it

XRP reserves are vanishing fast. Understand the mechanics behind the coming supply shock before the market wakes up. #xrp #fypシ #viral #trending

XRP Can't Break $100? Think again. Before dismissing XRP'S potential, understand the math behind the network. Study liquidity theory and available supply, then decide if $100 really is the limit. #fyp #fypシ #xrp #savingmoney

#Trust #fyp #viral

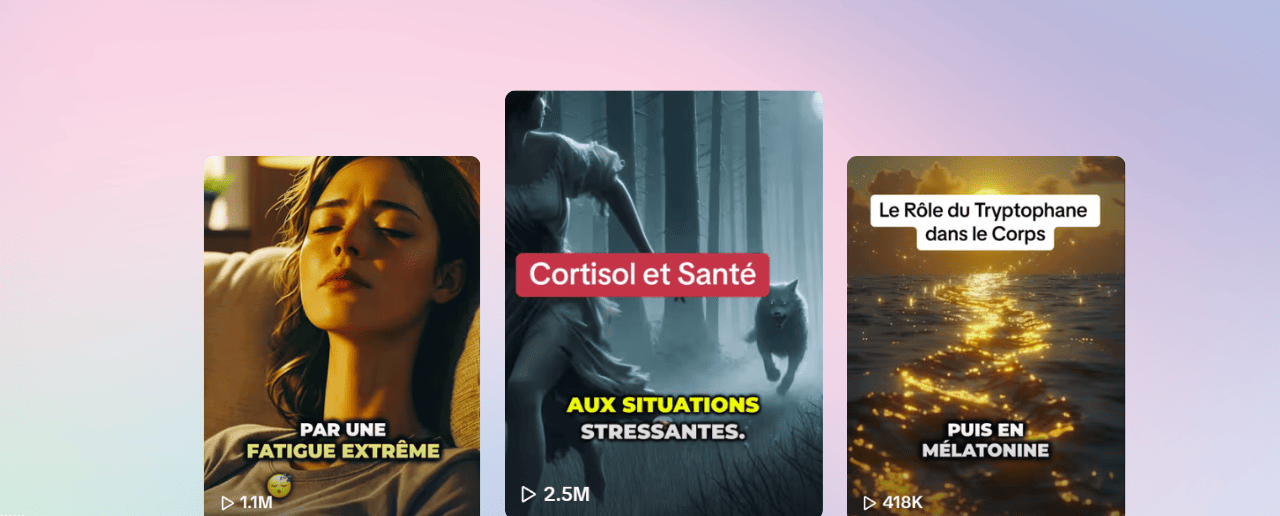

Texte → vidéo TikTok IA

Tu écris le prompt, on génère la vidéo.

#fypシ #estate

An LLC won't erase taxes, but it can slash what you owe through strategic deductions. Follow for more expert business tax strategies. #llc #tax #fypシ

Protect your crypto by taking full control through secure custody instead of leaving it at risk on exchanges. Explore custody solutions that match your risk profile and goals. #fyp #digitalassets #exchanges #viral

Sous-titres IA en 1 clic

Vidéo importée → version prête à poster.

Saving alone doesn't build wealth. Inflation erodes the value of money sitting idle. Investing in assets that appreciate or generate cash flow is what creates long-term financial growth. Follow for more. #savingmoney #fyp #trending #FutureOfFinance

#xrp #fypシ゚viral

#invest #investing #viral #fyp

The real opportunity isn’t in today’s market caps, but in the trillions in global assets that are about to move on-chain. Positioning yourself now could lead to life-changing gains over the next decade. Stay ahead of the curve.#fypシ #fyppppppppppppppppppppppp #fyp

Wealthy people don’t own their assets, they control them through structures that protect wealth and reduce taxes. Discover how you can apply the same strategies.#FutureOfFinance #fypシ #xrp #viral

- Je compte uniquement les vidéos ≥ 60 secondes (tu m’as dit que <60s = pas pris en compte).

- Calcul sur les 30 derniers jours (dans la limite des 35 dernières vidéos qu’on a dans le JSON).

- RPM estimé : 0.53€/1k vues (range 0.37–0.69) basé sur ER + save rate + durée moyenne.

- Résultat: 0€ sur 30j (range 0€–0€), pour 0 vues éligibles et 0 vidéos ≥60s.

- Emoji + note /10 = performance globale de la vidéo (views + ER + saves).

- ER = (Likes + Commentaires + Partages) / Vues • Save rate = Sauvegardes / Vues.

- Badges “Au-dessus / En dessous” = comparaison directe à la moyenne de TON compte.

Importe ta vidéo, et Vexub génère une vidéo sous-titrée prête pour TikTok, Reels ou Shorts. Pas de montage, pas de prise de tête.

- Reconnaissance vocale IA → texte propre

- Sous-titres syncro automatiquement sur la vidéo

- Format vertical optimisé pour les vues